Insurers have the opportunity to extend the telematics approach from cars to other insurance business lines to anticipate the coming of new technological players

The integration of technology in the Insurance Company’s value proposition is turning out to be one of the main evolutionary trends in the sector, and the “digital” initiatives have been for a couple of years now one of the priorities of Insurance Groups. Until today though they have brought only limited improvement when it comes to the competition abilities of the Insurer. The best practices at international level show that in order to obtain concrete benefits, the innovation has to be directed towards clearly determined strategic objectives: that is by clearly identifying how the adoption of a technological solution may allow the company to make the most of the opportunity at hand or to solve a critical issue of their business.

An interesting example of this kind is the American company Oscar – a start-up which in less than 2 years has managed to raise over 300 million dollars with a company value/worth of more than 1,5 billion dollars – that has radically innovated the customer experience of individual health insurance policies by directing the innovation effort towards two key factors, crucial for the profitability of the medical spending reimbursement business: deductible (amount of money payed directly by insured each year before Insurer have to reimburse) and “emergency” visits.

Oscar has created a new insurance value proposition based on a smartphone app which incorporates a highly advanced search engine – including a search based on symptoms – allowing the insured to indentify and compare the medical structures part of the preferred network. In this way the client receives support in optimizing direct spending before reaching the deductible; this basically postpones when the Insurance Company start to pay and thus reduces the amount of spending (medical reimbursements) made by the Insurer for the remainder part of the year. For that which regards the second point the company has introduced a chat with a specialist and call back system which the insured can choose at will from inside the network. This represents a comfortable alternative which in part reduces the number “not necessary” urgent visits.

Health insurance and connected health

In these last months I have been using the above considerations as a starting point when it comes to replicating the motor telematics experience for the health insurance business sector. We are now at the point where the Insurance Companies are aware of the benefits brought on motor insurance business by the black box and of how the return on investment in this type of technology can be maximized by the Insurer: this is possible by taking into consideration not only the underwriting of the car insurance policy but by also looking at the services provided to the client, by the loss control and by customer loyalization. Considering the health insurance business, there are a series of benefits which are achievable in the insurance value chain by using mHealth devices and wearables, benefits that can be identified by making a parallel with the auto insurance business.

The first element is the risk selection, either seen as:

- the capacity of auto selection and dissuasion of risky behavior,

- the integration of static variables traditionally used for pricing with a set of “telematics data” gathered within a limited period of time and used exclusively for supporting the underwriting phase.

The creation of a value proposition which is focused on the use of wearables within gamification processes makes the product attractive to individuals who are particularly interested in this topic – younger and healthier compared to the typical client of health insurance products – generating a self selection effect comparable with that which characterizes the motor telematics experiences. An interesting example of how to create an attractive product for the more active customers is the above-mentioned Oscar: since a beginning of January they have been offering to their clients a pedometer connected to a mobile app and every day the app shows a personalized objective that if attained, means 1 dollar earned by the customer. Each month the customer can receive a maximum of 20 dollars as cash-back from the company.

The second source of value generation is that of value added services. The use of telematics data represents an incredible opportunity for offering new health services and for offering a better customer experience: for example the geolocation of medical structures and doctors which are part of the network, linked to a medical reimbursement policy. One of the examples of major international success concerning value-added services is the Australian Medibank, which has integrated in their health policy (using a Smartphone app) a series of services built upon informative contents and advices, both medical – as done by the Italian insurance fund “Fondo Assistenza Benessere” by using an app called Consiglio dal Medico (Italian start-up partnering also with UBER) – as well as wellness related. Medibank using this package of services results in a 10% growth of the company’s top line. This Australian player has created an app for non customers which gives access to wellness discounts and thus making the best of the proposed value –added services in order to acquire new customers to whom subsequently offer the possibility to get insured (concrete cross-selling opportunity on a customer base, profitable on an insurance perspective).

The ability to provide health services with a high perceived value (from the client’s point of view) can also allow the company to increase the efficiency of its own processes of guidance inside the preferred network – this is a crucial aspect for controlling the loss ratio of a medical reimbursement product – and by maintaining a high standard customer experience. The loss control actually represents the thirds area of value creation just like it is for the auto business. Within the health industry it will soon be possible to concretize significant economical benefits employing telemedicine in order to optimize the spending with medical reimbursements or to link the reimbursement to the actual the observance of the client's medical prescriptions. On the mid-long timeframe the objective is that of having at disposal behavioral and contextual data to prevent frauds and early warning systems that can intercept altered health conditions and that allow preventive and timely intervention. South African based Discovery has successfully tried out this second approach: having the purpose of reducing the loss ratio of the cluster of insured that suffer from diabetes – mainly reimbursements linked to complications due to lack of self-control – it provides an instrument for measuring the blood sugar level through a connected app and it rewards the insured which makes use of it through the Vitality programme.

Vitality represents the International best practice regarding the fourth axis of value creation: behavior guidance by using a loyalty-based system which rewards non risky behavior. The South African company has integrated - in its very complex reward system – devices for measuring physical activity and has incorporated their usage among the “rewarded” types of behavior. Discovery’sexperience in several different countries proves the effectiveness of this approach in terms of:

- commercial appeal

- capacity to acquire less “risky” clients

- ability to gradually reduce the risk profile of the single client.

The pricing based on individual risk is the last benefit achievable with the integration of wearables and health insurance policies. More precise, it involves a constant monitoring of the “level” of exposure to risk during the period covered. The opportunity is getting to the point at which Insurer can create tariffs based on the monitoring of the health state, lifestyle and context of a person by the use of different devices. As already done in the auto telematics business, this will be a goal to be attained after some years of data gathering and systematic analysis of the historical series together with information which regards medical reimbursements.

Home insurance and connected home

Home insurance is another area in which, at an International level, there has been experimentation with how to integrate an insurance policy with actual sensors. In this context there already exists a replication of the business model used more than 10 years ago in the auto insurance sector: the first examples of telematics policies with an up-front discount between 10% and 25% of the insurance premium conditioned by the installation of a device at the client’s house and by the payment of a fee for services or a leasing agreement for the technology. This approach, which has been adopted in the US by State Farm,Liberty Mutual and USAA and in Italy by IntesaSanpaolo Assicura, BNP Paribas Cardif, Groupama e Poste is based upon two of the five levers of value creation mentioned earlier in the article: first the loss control – focused on risk related to flooding, fire and theft – and second, the association of value added services to the insurance policy. Regarding these two approaches, the American companies have even reached the point in which they offers to their clients a wide range of services provided by selected partners (Nest is a partner recently joined) and tied to the home “ecosystem” which can even include medical assistance services.

An interesting and innovative example of the use of such technology for the assessment and risk selection in home insurance is the one adopted bySuncorp with a retail touch to it, and by the ACE Group, which focuses more on the insurance needs of the HNWI. Both companies have used the partnership with a startup called Trōv – a Smartphone app which allows registering and organizing the information referring to personal objects including photos and receipts - in order to make evolve their underwriting approach when it comes to the risk connected to the contents of the house.

Domotics today is a sector which is growing at a high rate even in Italy and which represents a material part of the revenues generated by the Internet of Things within the Italian territory according to the data provided by the Osservatorio of the Politecnico di Milano. Focusing the possibilities of monitoring offered by the interconnected objects which are part of the horizontal domotics solutions – with thermostats, smoke and water detectors, sensors present in appliances and other household items, sensors at the entrance and antitheft alarms, sensors spread within the building – for an insurance company it would be possible to have a track of the quantity and level of exposure to risk. This includes for example the periods and ways in which the home is used but also the state of the household and the external conditions to which it is exposed (humidity, mechanical vibrations etc.).

This can allow the Insurer to build insurance policies with a pricing based on individual risk adopting a pricing logic which gravitates around behavior as already done in the motor sector, which could open up new growth opportunities like for example insurance for secondary houses used only for vacation and rarely insured. This scenario which sees the growth of solutions built upon interconnected objects within the home – if correctly approached by the Insures by reviewing their processes in order to make the most of the potential offered by gathered data – can lead to important benefits in terms of loss control: some studies have estimated that there is the potential to cut in half the current expenses for claims.

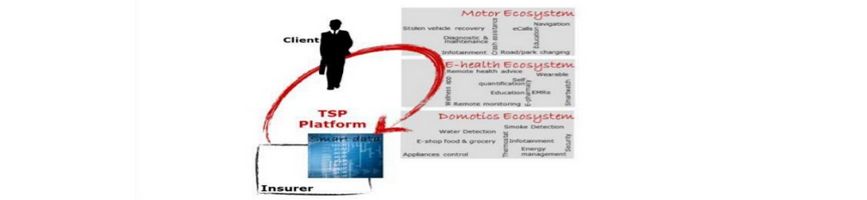

In order to turn this opportunity into reality, it is essential that the Insurer acquire the ability to connect its processes (through adequate interfaces) with the different interconnected objects: creating an open digital platform which “use” the multiple sensors to be found in the home “ecosystem” – just like those used in the health sector as discussed in one of the previous paragraphs – represents for the insurance sector a technologic challenge characterized by tremendous level of complexity compared to that which we have till now seen within the motor insurance sector.

The change of paradigm compared to the previous experience made with the black box for cars, doesn’t only concern the fundamental aspects of the technological architecture – like data gathering or standardization of data coming from heterogeneous sources - but it affect to the strategic choices of the business model. For Insurer it becomes a necessity to define their own level of ambition in that which regards their role in the ecosystem and the ways of cooperating with other players having the objective of creating solutions and services around an integrated set of client’s needs.

The Insurers have to start a strategic thinking around how adapt insurance business to IoT, before some new Fintech comers do it. It is extremely interesting the journey made by American Family Insurance, which - in partnership with Microsoft – has launched a start-up accelerator focused on home automation.

This article originally appeared in the Insurance Daily n. 749 and n. 750Editions